Eventually, though, you'll pay mainly primary. When you own realty, you need to pay residential or commercial property taxes. These taxes pay for schools, roadways, parks, and so on. In some cases, the loan provider develops an escrow account to hold money for paying taxes. The borrower pays a part of the taxes every month, which the lending institution places in the escrow account.

The home mortgage contract will require you to have homeowners' insurance coverage on the residential or commercial property. Insurance coverage payments are likewise often escrowed. If you require more details about home loans, are having difficulty deciding what loan type is best for your situations, or need other home-buying suggestions, consider calling a HUD-approved real estate therapist, a mortgage lender, or a genuine estate attorney.

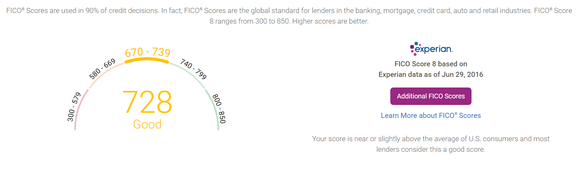

Applying for a home loan, and closing one, can be a laborious process. Lenders should scan your credit reports and study your credit score. You'll have to provide copies of such documents as your newest pay stubs, bank declarations and income tax return to verify your earnings. And the odds are high that you'll have to either fulfill personally or have several phone call or online chats with a mortgage officer.

There are plenty of home loan loan providers that now use what they call digital or online mortgages. But the reality is, many people who look for online home mortgages will often http://judahytme240.theburnward.com/the-3-minute-rule-for-what-are-reverse-mortgages-and-how-do-they-work have to speak to a loan officer and will usually require to get physical copies of their home loan documents and sign these documents throughout a conventional home mortgage closing, usually at a title company's office.

You might need to use for a home loan with a loan officer who can take your unusual circumstances into account when figuring out whether you certify. However there is no rejecting that online tech is slowly improving the home loan process. And while there is still a need for the human aspect, online financing is easing at least some of the headaches associated with making an application for a loan.

The Single Strategy To Use For How To Qualify For Two Mortgages

Today, though, consumers who are used to online food delivery, ride-sharing apps and Electronic banking, are significantly demanding that lenders automate more of the mortgage procedure. "For a long time, the home mortgage market has been seen as stagnant and full of human mistake. Homebuyers have actually associated the home mortgage procedure with stress and aggravation," Jacob The original source stated.

Online lenders also enable debtors to fill out their property loan applications at their web websites, removing the requirement to mail, drop off or fax this finished form to a physical place. These modifications can save time. Jacob said that it can take traditional mortgages as much as 45 days to close.

Tom Furey, co-founder and senior vice president of item development, finance and lending, with Stone, Colorado-based Neat Capital, stated that online home mortgages are frequently cheaper. That's due to the fact that companies like his-- Neat offers digital mortgages-- utilize technology to get rid of the ineffectiveness of the conventional mortgage-lending procedure. This results in faster closing times and less administrative expenses, Furey stated.

" Underwriting takes place in the background weeks after clients receive a pre-approval." Neat Capital depends on what Furey calls a digital real-time approval system that asks particular questions of customers. Furey states that Neat Capital's application engine might ask the length of time a customer will receive earnings from alimony payments or for how long they have actually earned a certain series of self-employment earnings.

But instead of needing customers to find copies of their tax returns or print out copies of their checking account declarations, Neat utilizes connecting innovation to validate the properties of the majority of its debtors automatically, scanning the connected savings account and retirement funds of these buyers to determine how much money they have in each of them.

Some Known Incorrect Statements About Which Credit Report Is Used For Mortgages

Debtors who are worried about connecting their accounts have the alternative of publishing PDF versions of their statements, and Neat will only pull data from linked accounts if their borrowers give their approval. This linking procedure, though, does speed the lending procedure, and spares debtors from having to make copies of their tax returns, bank declarations, retirement fund balances and credit card statements. what kind of mortgages are there.

Furey stated that the business does use these human mortgage specialists in case debtors do have concerns and need to talk to a loaning professional. "It's likely the biggest purchase an individual will ever make, so it's vital they feel supported," Furey stated. Josh Goodwin, founder of Tampa, Florida-based Goodwin Home mortgage Group, states that while online home mortgage financing is hassle-free and typically features lower home loan interest rates and fees, it's not perfect.

Say you make a considerable piece of your income from freelance work. You might need to speak to a real human loan officer so that you can explain why this work, though freelance, is steady, indicating your long history of agreement work as evidence. The exact same may be real if you recently suffered a temporary reduction in your annual income.

However if you meet a loan officer in Visit this website individual, you can describe that your income drop was only short-lived, which you have considering that landed a new, higher-paying task. Goodwin stated that customers without best credit or with odd income streams may do better to look for a loan the old-fashioned way, by conference, or at least speaking by phone, with a home loan officer.

That lender approved the debtor for a loan of just $68,000. When that very same debtor came to Goodwin, he had the ability to authorize him for a loan of $280,000. As Goodwin states, conference in individual with a loan officer can result in a more customized mortgage-lending experience. "The entire homebuying process can be a demanding experience for numerous buyers," Goodwin stated.

The 7-Second Trick For What Is The Catch With Reverse Mortgages

Debtors might believe that all online loan providers can operate in all 50 states. This isn't always the case. Neat Capital notes the states in which it can operate on its homepage. The business also includes a link to the NMLS Customer Gain access to site, a website that lets debtors look for loan officers and figure out where they are certified to do company.

Simply because you begin a mortgage application online, doesn't mean that you'll never satisfy face to face with lending experts such as a loan officer or title representative. Consider the closing process. According to the 2018 J.D. Power Primary Mortgage Origination Study, almost half of all customers report receiving their closing files as a hard copy personally, while another 3rd get them as tough copy through the mail.

Power, said that most loan closings still take location in a title company workplace, in individual, with the homebuyers signing the essential paperwork to complete the home loan "Lenders and customers all have some level of confusion and disagreement about precisely what makes up a 'digital home mortgage,'" Cabell said. Cabell stated that the J.D.

Cabell stated, too, that customers mention a higher level of satisfaction when utilizing a mix of individual and self-service. It might make one of the most sense, then, for customers to deal with loan providers who permit them to complete loan applications online and submit loan documents through an online website however likewise provide access to knowledgeable loan officers who can help walk them through the financing procedure.